- Investment Intelligence

- Posts

- AI Banking Revolution

AI Banking Revolution

+ The KRE Rate Cut Play That Could Mirror Big Bank Gains

The Foundation of a Healthy Bull Market

Listen up! The financial sector has emerged as one of the top three performing sectors year-to-date, delivering an impressive 10% return alongside Technology (14% YTD) and Industrials (15% YTD). When Financials, Technology, and Industrials are all leading simultaneously, you've got the holy trinity of a healthy bull market. This isn't some speculative garbage—this is real economic strength across multiple dimensions.

S&P 500 Sector Returns YTD

With Financials positioned as a top performer, we need to dive deeper into this sector to uncover the most compelling opportunities. The intersection of traditional banking strength with transformative AI technology is creating money-making opportunities that smart money is already positioning for.

The AI Transformation: $73 Billion Reasons to Pay Attention

Here's the deal: Financial institutions are projecting $73 billion in AI investments for 2025, with potential profit improvements of 2-9% industry-wide. The AI in fintech market is exploding from $18.78 billion in 2025 to $296.73 billion by 2033—that's a 41.2% compound annual growth rate. Banks deploying AI are seeing average ROI of 3.5x within 18 months.

But here's what separates the winners from the losers: base breakouts. We're seeing massive technical formations across the entire financial AI space, and I'm about to show you exactly where the smart money is moving.

The Base Breakout Bonanza: Five Monster Setups

JPMorgan Chase (JPM): The $280 Breakout King

JPM just smashed through its critical $280 resistance level—the former all-time high that now serves as rock-solid support. This isn't some penny stock nonsense; this is the AI investment powerhouse, a leader in the industry with $1.5 billion in annual AI spending.

The Setup: Long above $280, targeting $328.50. Any dip towards $285 is a gift. If it breaks $280, we reevaluate.

JPM's LLM Suite serves 200,000+ employees—the largest Wall Street AI deployment. Their COiN system saves 360,000 work hours annually. This is AI revenue generation in real time.

Bank of America (BAC): The Continuation Pattern Breakout

BAC just broke out of a beautiful bullish continuation pattern above $48—and it's pulling back right now, giving you a second chance at this trade. This bank holds over 1,100 AI patents—more than any other financial services company.

The Setup: Long above $48, targeting $57. The pullback is your entry opportunity.

Their Erica virtual assistant has generated 2.4 billion interactions. That's not hype—that's operational efficiency driving real margins.

Citigroup (C): The Base-on-Base Formation

C is showing a shorter-term base formation sitting right on top of its prior base breakout—this is institutional accumulation at higher levels. Under CEO Jane Fraser, they've equipped 150,000 employees with AI tools.

The Setup: Long above $98, targeting $102-$103 range. Base-on-base patterns are explosive.

AI applications have delivered a 50% improvement in cash forecasting and 90% reduction in operational case times. This is a turnaround story with AI as the catalyst.

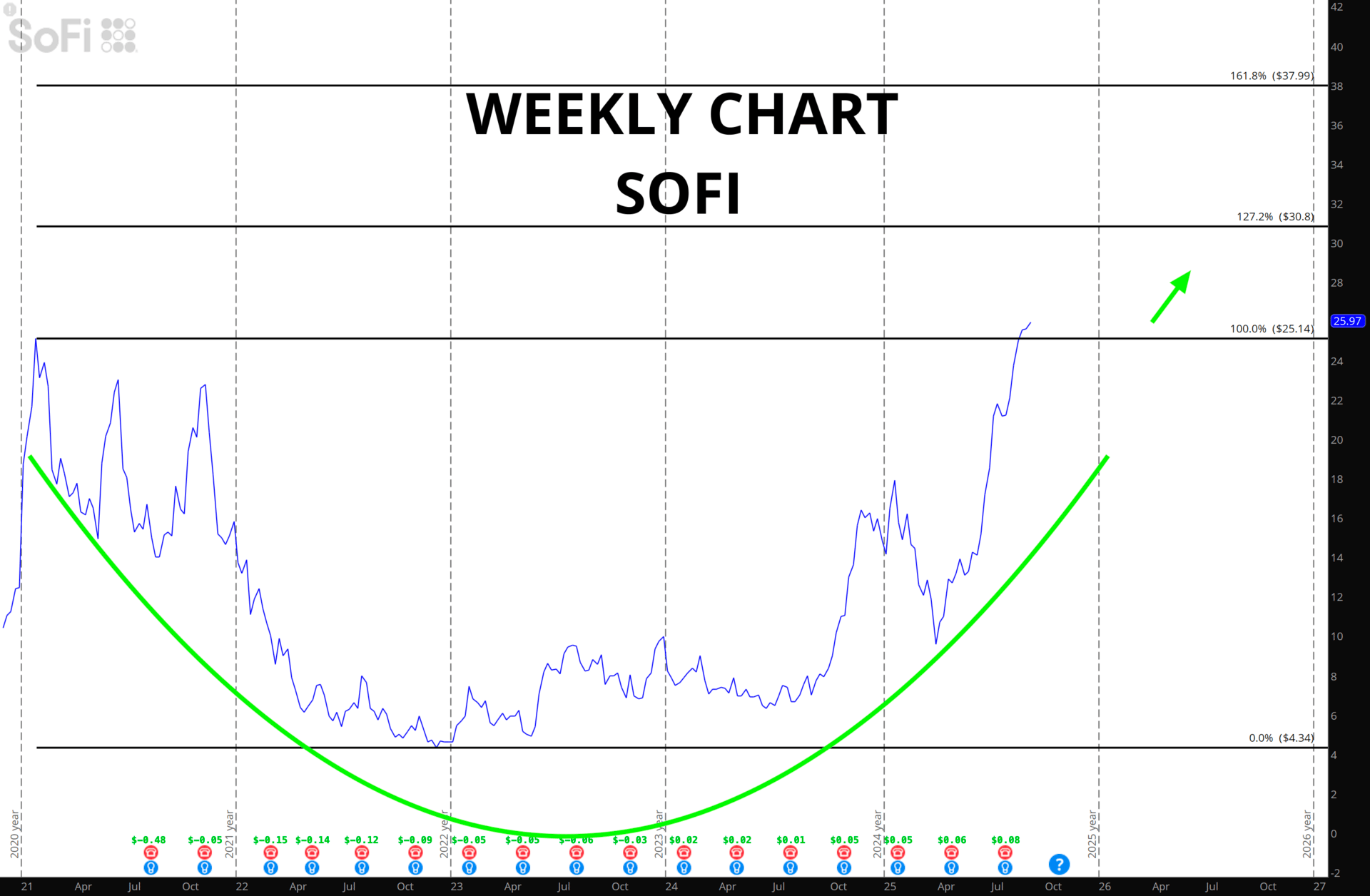

SoFi Technologies (SOFI): The Multi-Year Monster

Here's the crown jewel—SOFI just completed a massive multi-year base breakout. This is the kind of technical pattern that creates generational wealth. They've added 850,000 new members in Q2 2025 with 44% year-over-year growth.

The Setup: Long above $25, targeting $30 then $38. If it closes below $25, we reevaluate.

Multi-year base breakouts are the holy grail of technical analysis. When you combine that with AI-driven growth and exposure to OpenAI through private market funds, this is a no-brainer.

Affirm Holdings (AFRM): The Profitable AI Play

AFRM just achieved its first GAAP profit while revenue jumped 33% to $876 million. Their Adapt AI platform drives 5% GMV increases for merchants while cutting customer acquisition costs by 50%.

The Setup: Long above $82.50, targeting $114. That's 33% upside potential on a newly profitable AI-driven business model.

The Short-Term Opportunity: Robinhood (HOOD)

HOOD's S&P 500 inclusion is creating massive institutional buying pressure. Year-to-date gains of over 200%, and we're just getting started.

The Setup: Long above $118, targeting $123 then $130. S&P inclusion creates sustained buying as index funds rebalance.

Their Robinhood Cortex AI platform is creating network effects that deepen user engagement. This isn't just a trading app anymore—it's an AI-native financial services platform.

The Regional Bank Rate Cut Play: KRE - The Laggard Ready to Explode

Here's where it gets really interesting. Look at the chart comparing big banks to regional banks (KRE). For years, these two moved in perfect lockstep—until recently. Big banks have exploded to new all-time highs, while KRE has failed to breakout and make new highs.

The market is waiting. Waiting for what? Rate cuts.

Regional banks benefit disproportionately from rate cuts—their deposit costs drop faster than lending rates, expanding margins. After 2023's banking crisis eliminated 140+ regional banks, survivors have less competition and proven resilience.

But here's the kicker: Regional banking valuations remain well below their peak in 2017. This is value investing meeting technical breakout potential.

KRE P/E Ratio

The Setup: When KRE breaks out, it could mirror the explosive move we've already seen in big banks. The divergence is your opportunity—the convergence will be your payday.

The chart pattern is screaming: if we get rate cuts and that KRE breakout, regional banks could play catch-up in spectacular fashion. That's the kind of asymmetric risk-reward setup that builds wealth.

The Investment Thesis: Why This Works

We've got sector leadership (Financials up 10% YTD), massive AI investment ($73 billion in 2025), and technical breakouts across the board. AI automation is cutting operational costs by 13% on average, with some banks achieving 22% reductions.

The convergence is perfect: AI transformation, base breakouts, S&P 500 inclusion dynamics, and rate cut tailwinds. This is how you build wealth—you find the intersection of fundamental change and technical momentum, then you position accordingly.

The bottom line: JPM, BAC, C, SOFI, and AFRM are showing textbook base breakouts with AI-driven fundamentals. HOOD offers short-term momentum from S&P inclusion. KRE provides the rate cut angle with beaten-down valuations and explosive catch-up potential.

This isn't speculation—this is strategic positioning in the financial services revolution. The base breakouts are telling you exactly where institutional money is flowing. The KRE divergence is telling you where the next big move is coming. Are you listening?

Don't Miss the AI Banking Revolution

The opportunity is right in front of you. These aren't hope-and-pray trades—these are technical setups backed by fundamental AI transformation happening right now. The charts are speaking. The money is moving.

Start building your positions today. Scale into these names on any weakness, manage your risk with the levels I've given you, and ride the wave that's already begun. In five years, you'll either be part of the AI banking revolution or watching it from the sidelines.

The choice is yours. What are you going to do about it?

Until next time,

Investment Intelligence

Investment Intelligence Disclaimer: This article is for informational purposes only and not intended as investment advice. Always conduct your own research before making any investment decisions. Investment Intelligence is a financial publication of general circulation and provides impersonal advice, not tailored to individual needs. The comments or statements made in our newsletter do not necessarily reflect those of Investment Intelligence or its affiliates and should not be considered as buy or sell recommendations. Unless explicitly indicated, the content of any email communication from Investment Intelligence is not an official confirmation of any transaction. The recipient acknowledges that any use of this transmission and its attachments is at their own risk, and Investment Intelligence accepts no responsibility for any loss or damage arising from their use. It is the recipient's responsibility to ensure the emails are virus-free. Please note that we are a public investor and do not seek any material non-public information. We do not agree to keep any information confidential unless pursuant to a written confidentiality agreement executed by Investment Intelligence. Investment Intelligence does not agree to any restrictions on our trading activity, except as specified in a written agreement. Affiliate Disclosure: Investment Intelligence may be affiliated with certain entities and may receive cash compensation for referrals of clients who open accounts with those entities. Investment Intelligence may also receive compensation from product sponsors related to recommendations. Please be aware that by subscribing to Investment Intelligence, you agree to the terms and conditions outlined in this disclaimer. If you have any concerns or questions, please do not hesitate to contact us. Thank you for being a valued member of our community