- Investment Intelligence

- Posts

- August Winners: +40% Reddit, +34% Tempus AI - Full Report Inside

August Winners: +40% Reddit, +34% Tempus AI - Full Report Inside

August Results: 71% win rate, 12% returns

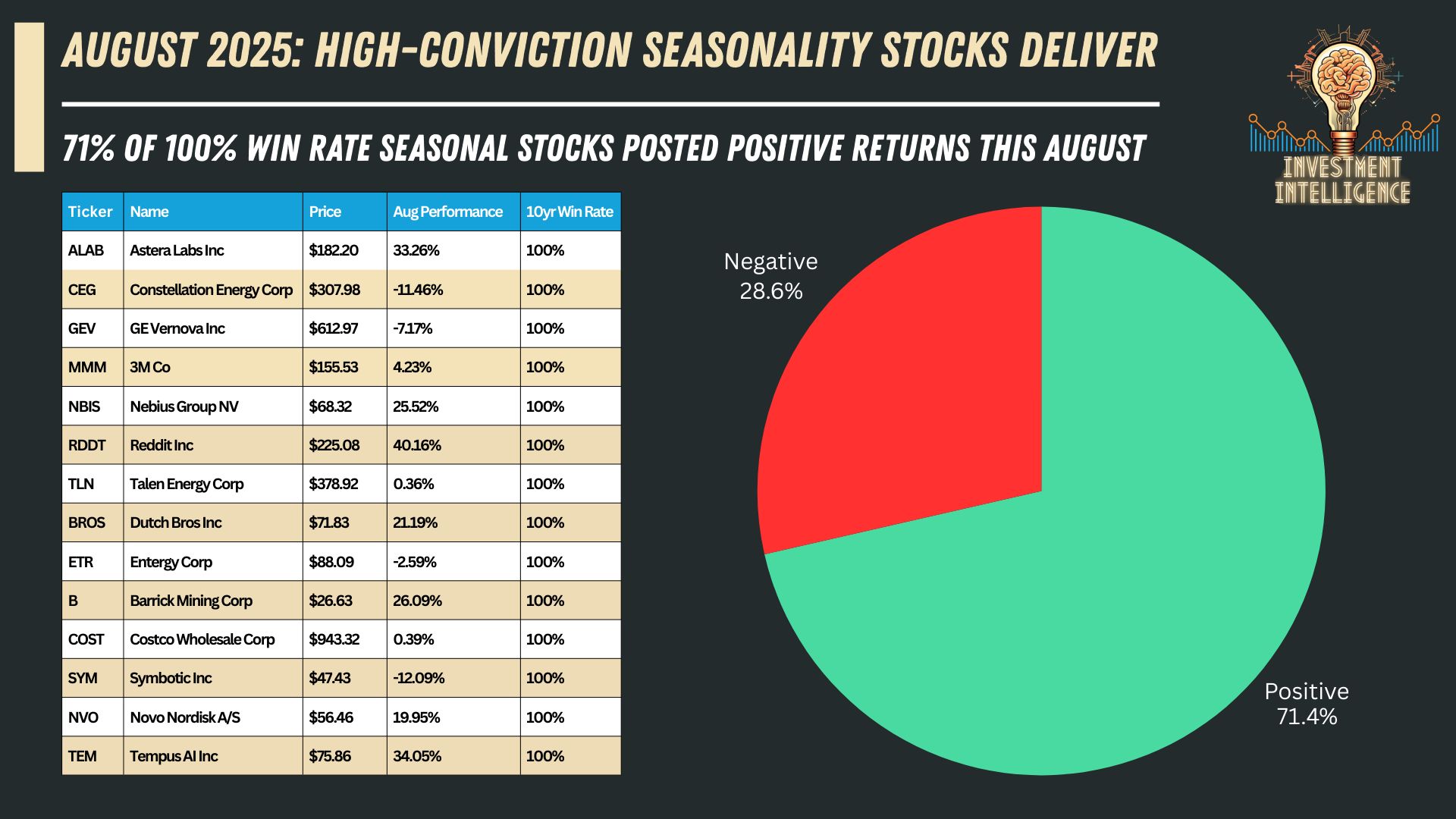

The August Success Story: 71% Win Rate

August seasonality analysis delivered impressive results that showcase the power of combining historical data with strategic positioning. Out of 14 carefully selected stocks with perfect 10-year August win rates, 71.4% posted positive returns this month, significantly outperforming typical market expectations.

Portfolio Performance Highlights

The numbers speak for themselves:

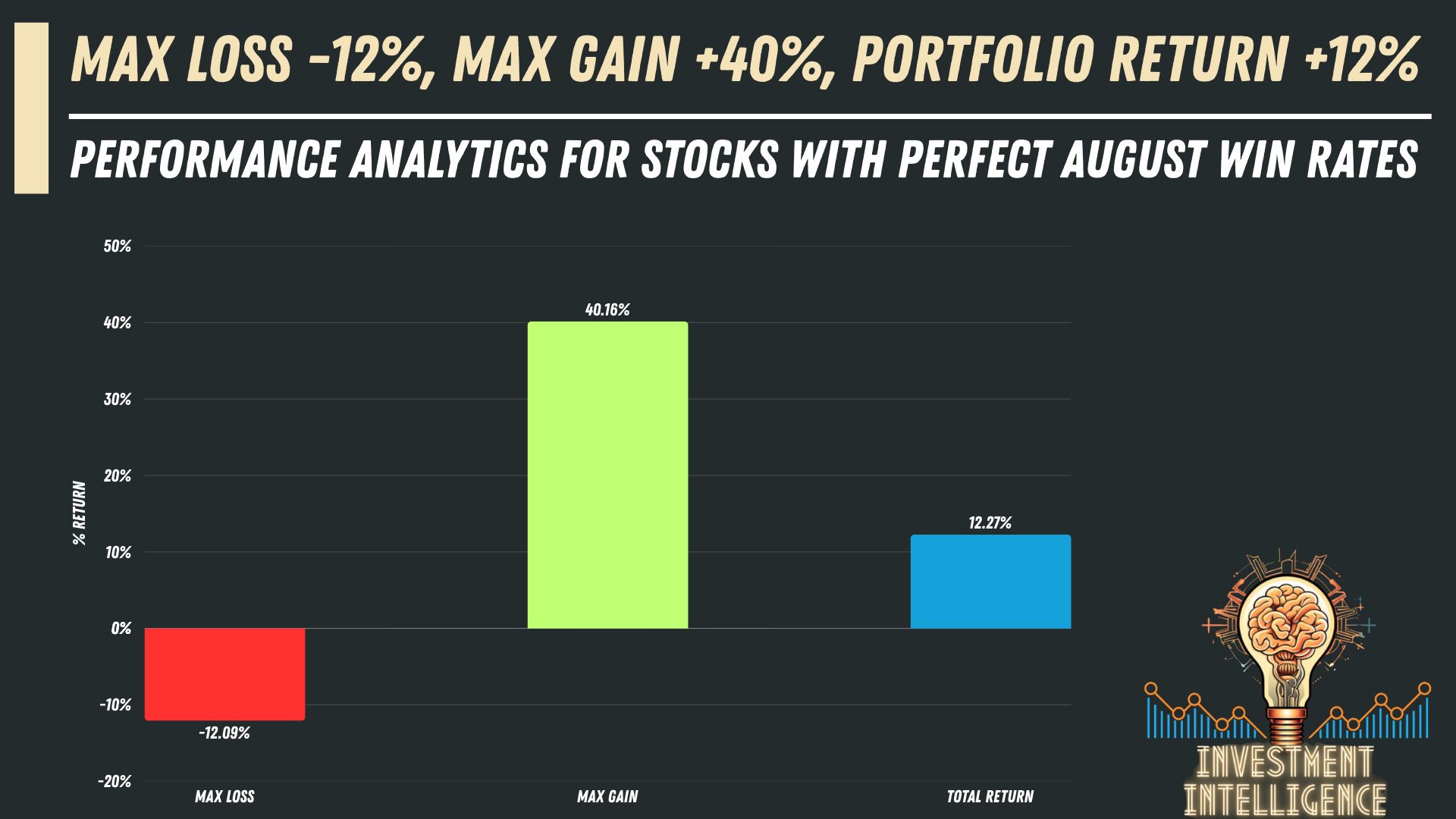

Portfolio Return: +12.27% for the month

Maximum Gain: +40.16% (Reddit Inc - RDDT)

Max Loss: -12.09% for the month

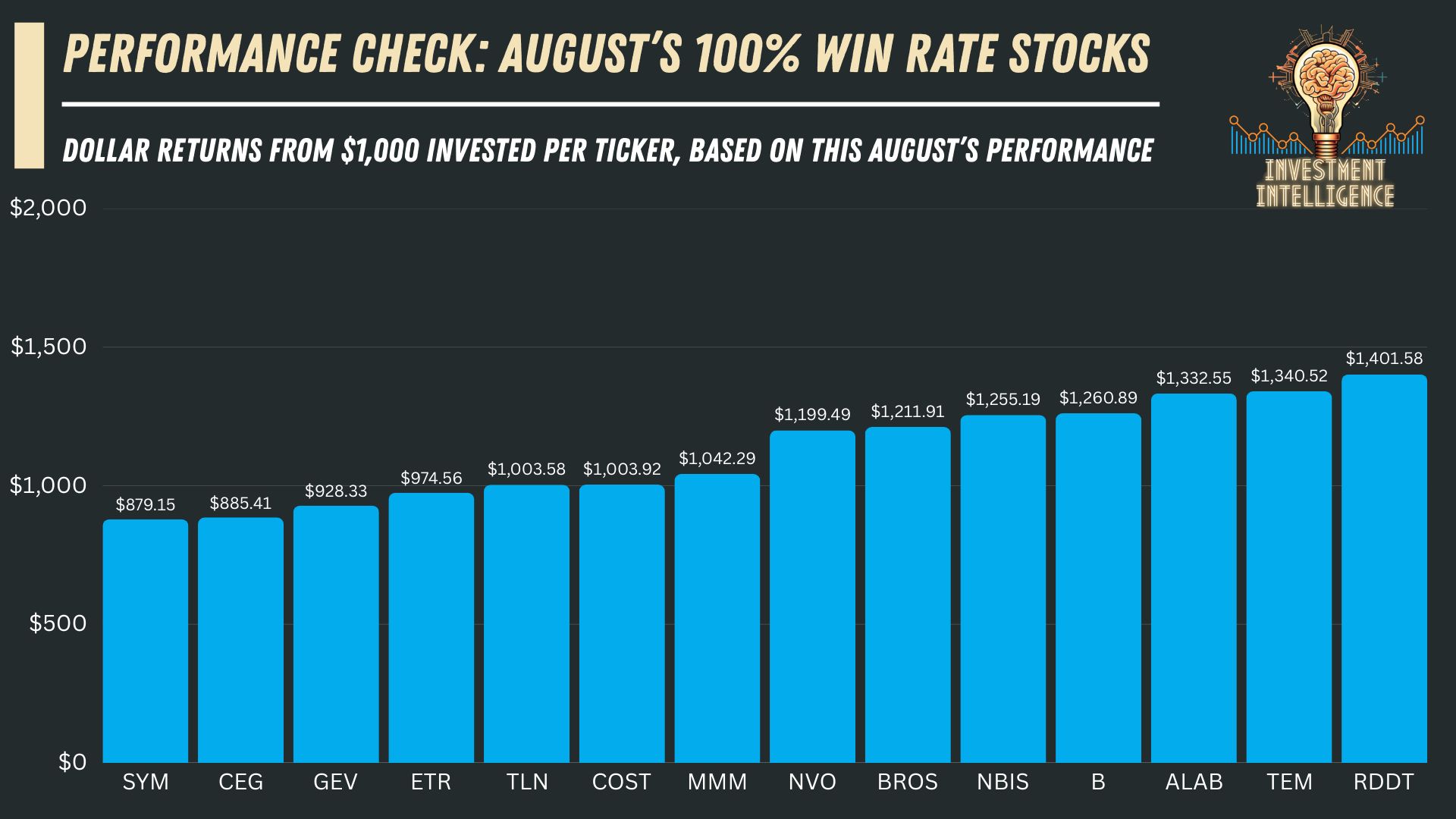

Dollar Returns Performance Check: The Equal-Weight Approach

To demonstrate the real-world impact of our seasonality analysis, we conducted a simple equal-weight investment simulation using the 14 stocks with perfect 10-year August win rates. This basic approach involved investing $1,000 into each ticker to begin August – no leverage, no options, no tactical timing.

The methodology was intentionally straightforward:

$1,000 invested in each of the 14 selected stocks

Total portfolio investment: $14,000

Equal weighting across all positions

Buy-and-hold for the entire month of August

No expert technical analysis applied to entry/exit points

The results speak to the power of historical seasonality patterns alone:

Total Portfolio Value: $15,719 (up from $14,000)

Overall Return: +12.27% for the month

Best Performer: Reddit Inc (RDDT) returned $401.58 on a $1,000 investment (+40.16%)

Worst Performer: Symbotic Inc (SYM) lost $120.85 on a $1,000 investment (-12.09%)

This chart illustrates what would have happened with the most basic implementation of our seasonality data – simply buying equal amounts of each 100% win rate stock and holding through August. Imagine the potential when we add our expert technical analysis, strategic entry/exit timing, and advanced position sizing to this historical edge.

The 71% success rate achieved through this elementary approach validates that seasonal patterns provide a genuine statistical advantage, even before applying sophisticated trading techniques.

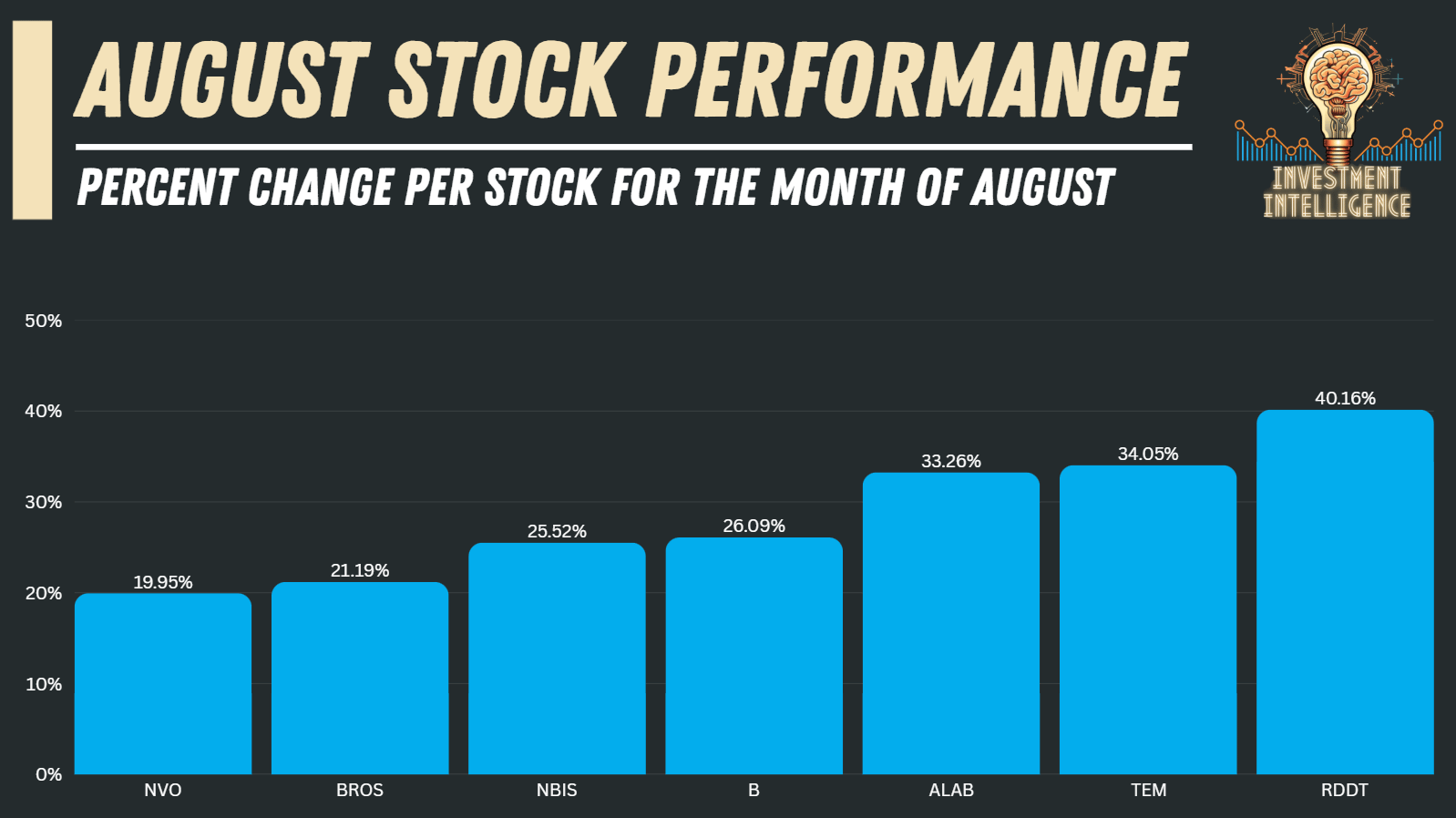

Top Performers: When Seasonality Meets Market Reality

Several standout performers demonstrated the power of our seasonality-focused approach with 20% or more returns:

The Science Behind Our Seasonality Edge

Our methodology is built on rigorous historical analysis:

10-Year Historical Data: We analyze decade-long performance patterns to identify consistent seasonal trends

Minimum 80% Single Month Win Rate: Only stocks with proven historical success make our monthly "shopping lists"

100% Win Rate Focus: We prioritize stocks with perfect historical records for the current/upcoming month for maximum edge potential

Risk-Aware Approach: We acknowledge that past performance doesn't guarantee future results, but provides statistical advantage

Beyond the Numbers: Expert Analysis Makes the Difference

Raw seasonal data is just the foundation. Our true competitive advantage comes from combining this historical intelligence with expert technical analysis. We don't just identify seasonal patterns – we provide the strategic context and timing that transforms data into profitable trades.

This is where seasonal science meets trading art.

What This Means for September and Beyond

While August's 71% success rate validates our approach, we're already preparing September's seasonality intelligence. Each month brings new opportunities as different sectors and stocks enter their historically favorable periods.

Our system continuously scans for:

Stocks entering high-probability seasonal windows

Technical setups that align with seasonal bias

Risk management parameters for each position

Entry and exit strategies optimized for seasonal patterns

Join the Seasonality Revolution

The August results represent just the beginning of what's possible when you combine historical edge with expert analysis. Our Seasonality Playbook is launching exclusively to our private trading community members this September, with full public launch coming soon.

What You'll Get Access To:

Monthly Seasonality Reports: Detailed analysis of stocks entering favorable seasonal periods

Expert Technical Analysis: Professional chart analysis and entry/exit strategies

Real-Time Trade Ideas: Actionable recommendations combining seasonal edge with technical setups

Historical Performance Tracking: Transparent results and performance metrics

Exclusive Discord Access: Direct interaction with our analysis team and fellow traders

Ready to Gain Your Seasonal Edge?

Don't wait for the public launch. Join our private trading community today for FULL ACCESS to September's seasonality playbook, plus all our premium trade ideas and resources.

The market rewards those who prepare. Seasonality gives you the preparation advantage.

Until next time,

Investment Intelligence

Investment Intelligence Disclaimer: This article is for informational purposes only and not intended as investment advice. Always conduct your own research before making any investment decisions. Investment Intelligence is a financial publication of general circulation and provides impersonal advice, not tailored to individual needs. The comments or statements made in our newsletter do not necessarily reflect those of Investment Intelligence or its affiliates and should not be considered as buy or sell recommendations. Unless explicitly indicated, the content of any email communication from Investment Intelligence is not an official confirmation of any transaction. The recipient acknowledges that any use of this transmission and its attachments is at their own risk, and Investment Intelligence accepts no responsibility for any loss or damage arising from their use. It is the recipient's responsibility to ensure the emails are virus-free. Please note that we are a public investor and do not seek any material non-public information. We do not agree to keep any information confidential unless pursuant to a written confidentiality agreement executed by Investment Intelligence. Investment Intelligence does not agree to any restrictions on our trading activity, except as specified in a written agreement. Affiliate Disclosure: Investment Intelligence may be affiliated with certain entities and may receive cash compensation for referrals of clients who open accounts with those entities. Investment Intelligence may also receive compensation from product sponsors related to recommendations. Please be aware that by subscribing to Investment Intelligence, you agree to the terms and conditions outlined in this disclaimer. If you have any concerns or questions, please do not hesitate to contact us. Thank you for being a valued member of our community