- Investment Intelligence

- Posts

- The Power of Three

The Power of Three

A Repeatable Strategy for Explosive Gains

The Setup That's Been Crushing It All Year

Let's talk about one of our absolute favorite trading setups—and trust me, when I say favorite, I mean this thing has been printing money consistently. We're talking about a simple three-component strategy that's so reliable, it almost feels like cheating.

The Magic Three Components

1. Price Breakout: Where the Action Begins

First up, we're hunting for price breakouts—those beautiful moments when a stock finally says "enough is enough" and smashes through resistance like it's made of paper. This isn't just any random price movement; we're looking for that decisive break that screams "institutional money is moving in!"

When you see a stock breaking out, that's your first signal that something big is about to happen. It's like watching a dam burst—once that selling pressure gives way, the flood of buying can be absolutely explosive.

2. Volatility Compression: The Calm Before the Storm

Here's where it gets really interesting. We want to see volatility compression right at the lows—think of it as the market holding its breath before a massive sneeze. That's your cue that pressure is building up like a coiled spring.

The longer this compression lasts, the more violent the eventual breakout becomes. It's basic physics applied to trading—all that pent-up energy has to go somewhere, and when it does... chef's kiss.

3. Momentum Breakout: The Final Confirmation

Last but definitely not least, we need our momentum indicator to give us the thumbs up. We're talking RSI here—our trusty sidekick that confirms this isn't just another head fake.

When RSI breaks out, that's when you know this move has real legs. No more guessing games—the momentum is there, and it's time to ride the wave.

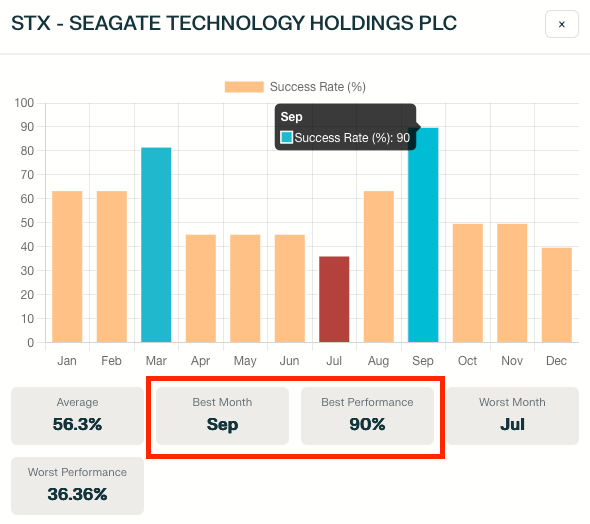

STX: The September Superstar

Okay, let me blow your mind with this STX example. Not only does this beast have a 90% win rate in September (yes, you read that right—NINETY PERCENT!), but it's also one of the crown jewels in our seasonality dashboard.

Quick side note: if you haven't checked out our August seasonality report yet, you're missing out on pure gold. We've got over 300 stocks tracked with 80-100% historical win rates during specific months. That’s the power of our Seasonality Playbook.

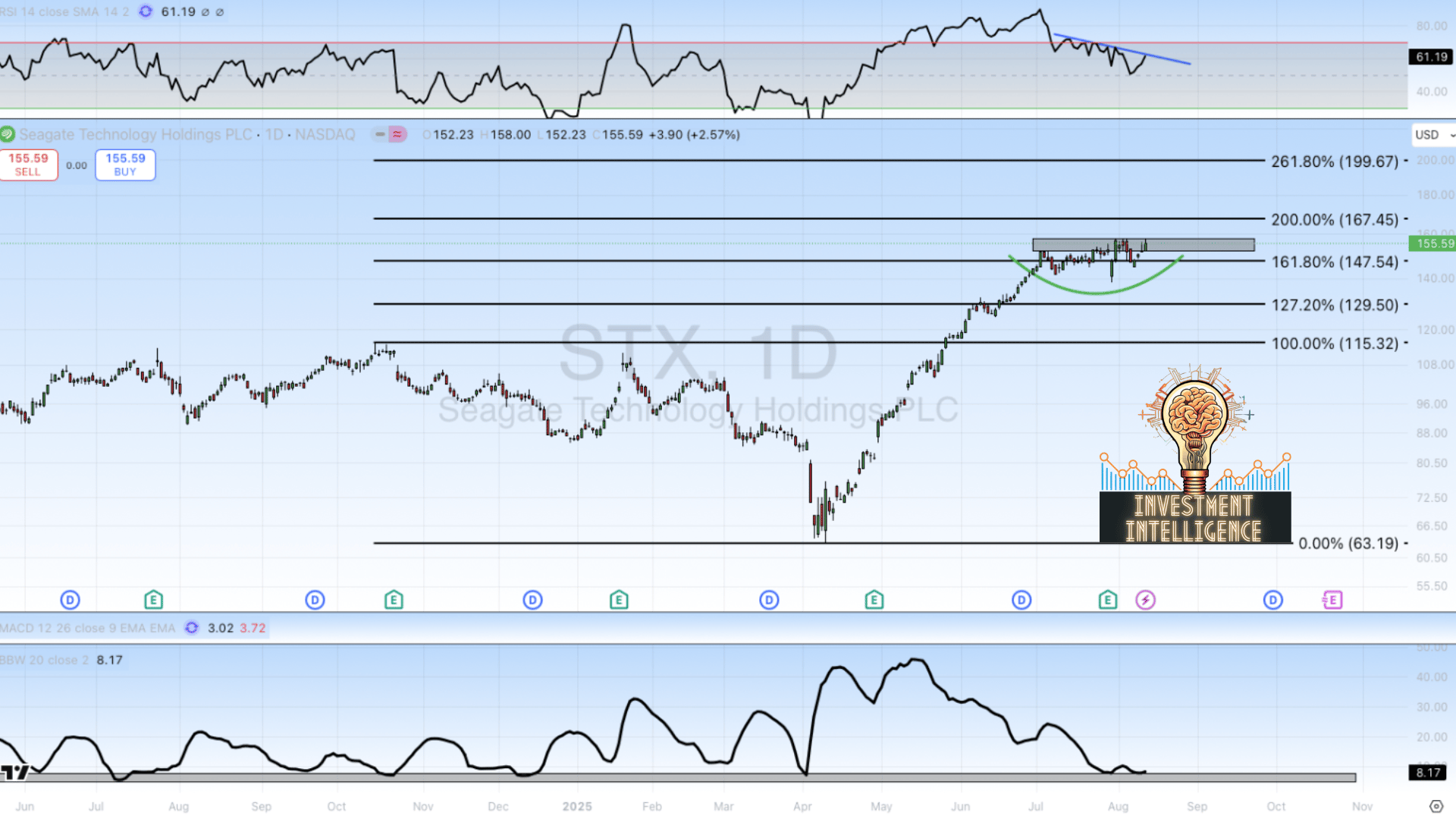

Back to STX—on August 13th, we spotted this setup forming and alerted everyone to watch for longs above $158 on the breakout.

STX DAILY CHART 8/13

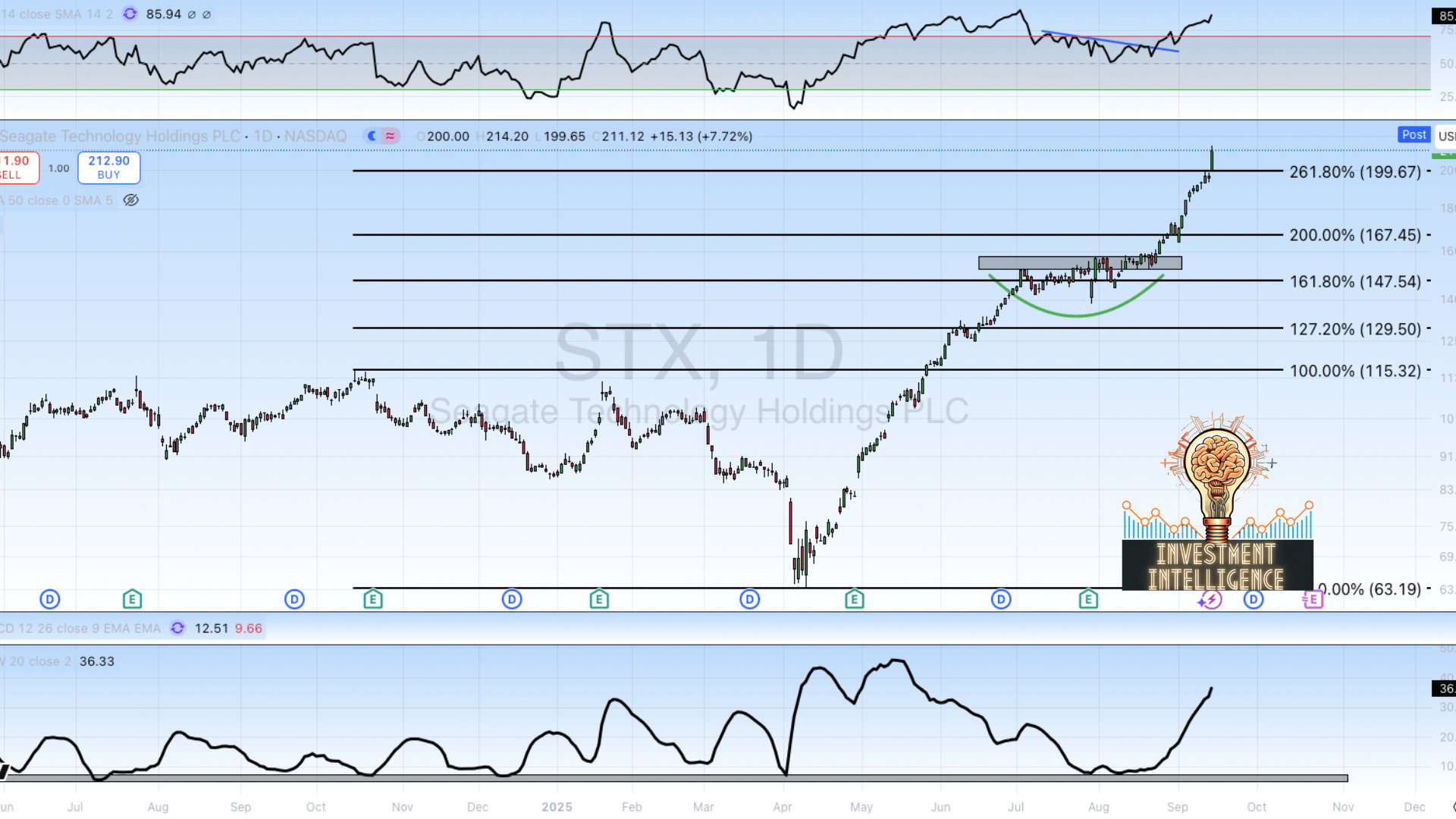

Fast forward to today, and this beauty is trading above $210! Check all three boxes: ✅ Price breakout, ✅ Volatility squeeze fired, ✅ Momentum confirmation. This isn't luck, folks—this is what happens when you stick to a proven system.

STX DAILY CHART 9/15

Monday's Double Knockout: 100%+ Gains in ONE DAY

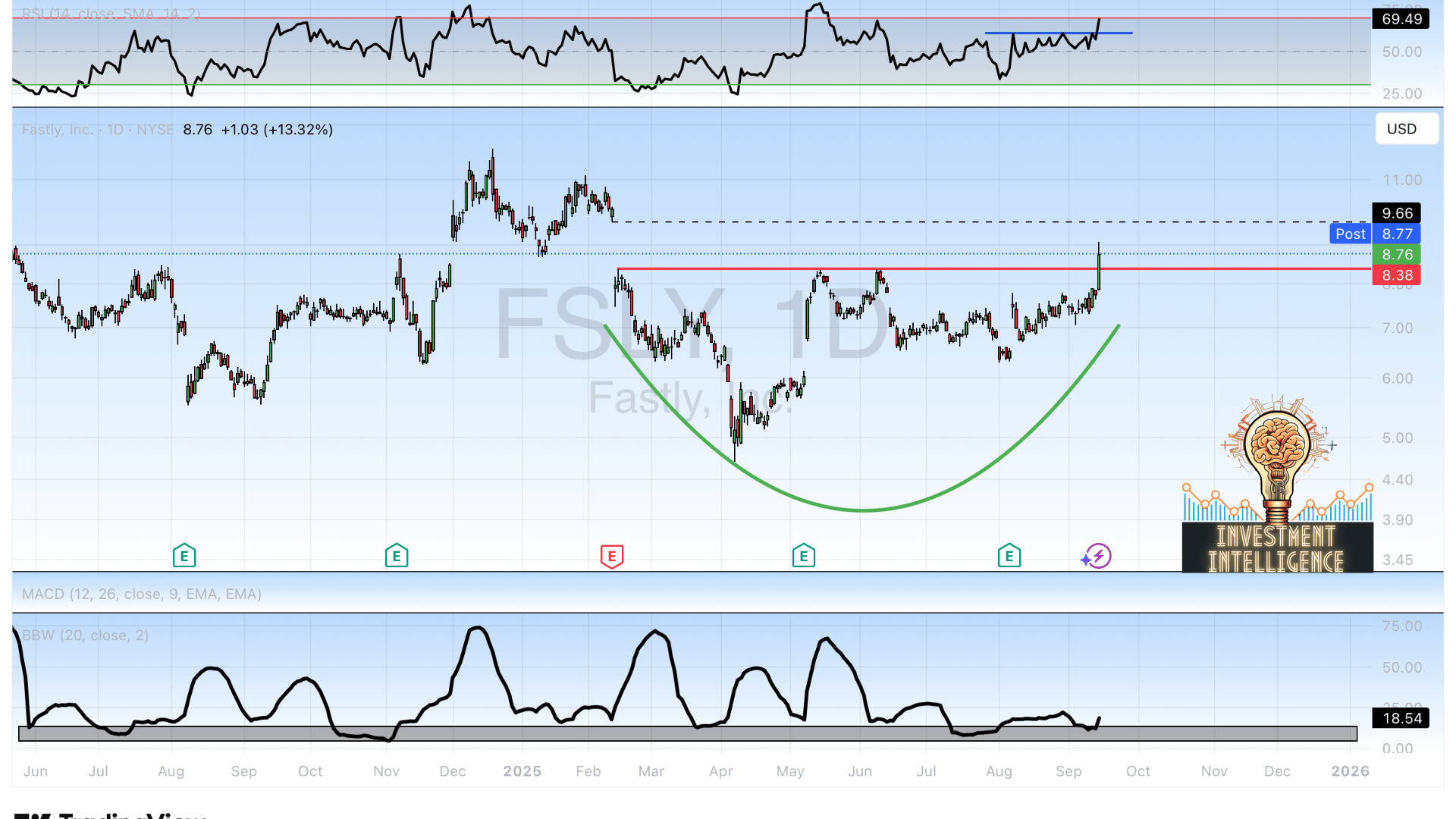

Now here's where things get absolutely insane. From our analysis, we spotted two setups that had all three components lined up perfectly. And guess what? BOTH of them exploded Monday!

Fastly (FSLY) was the first knockout punch:

Clean base breakout ✅

Volatility bouncing off the lows ✅

Momentum breaking out ✅

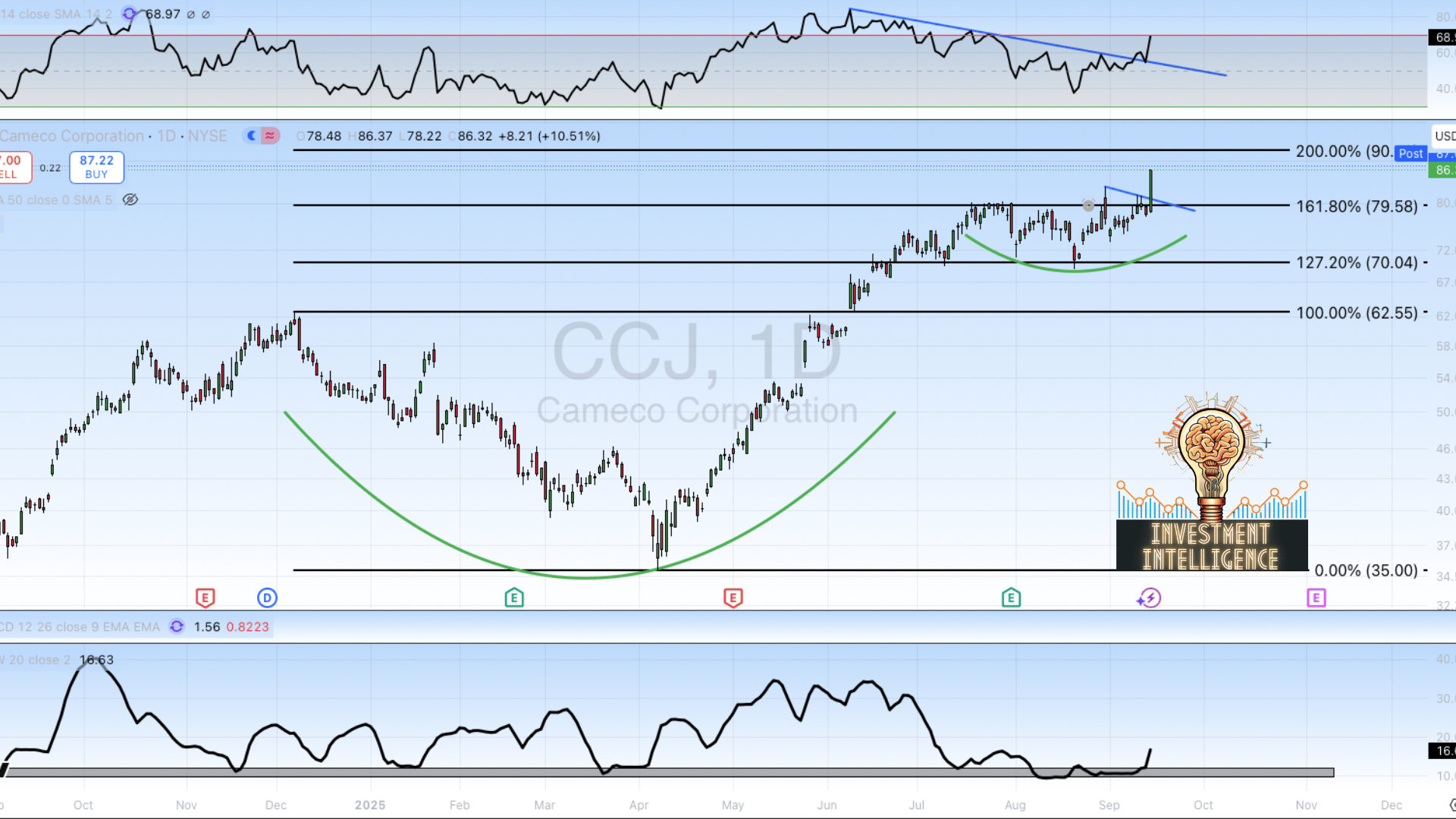

Cameco Corporation (CCJ) delivered the second haymaker:

Beautiful trendline breakout ✅

Volatility bouncing off the lows ✅

RSI confirming momentum ✅

Here's the kicker—if you played these with the October opex call options you could have bagged 100%+ gains on BOTH trades Monday before dinner! Same. Day. Entry. Now that's what I call a good Monday!

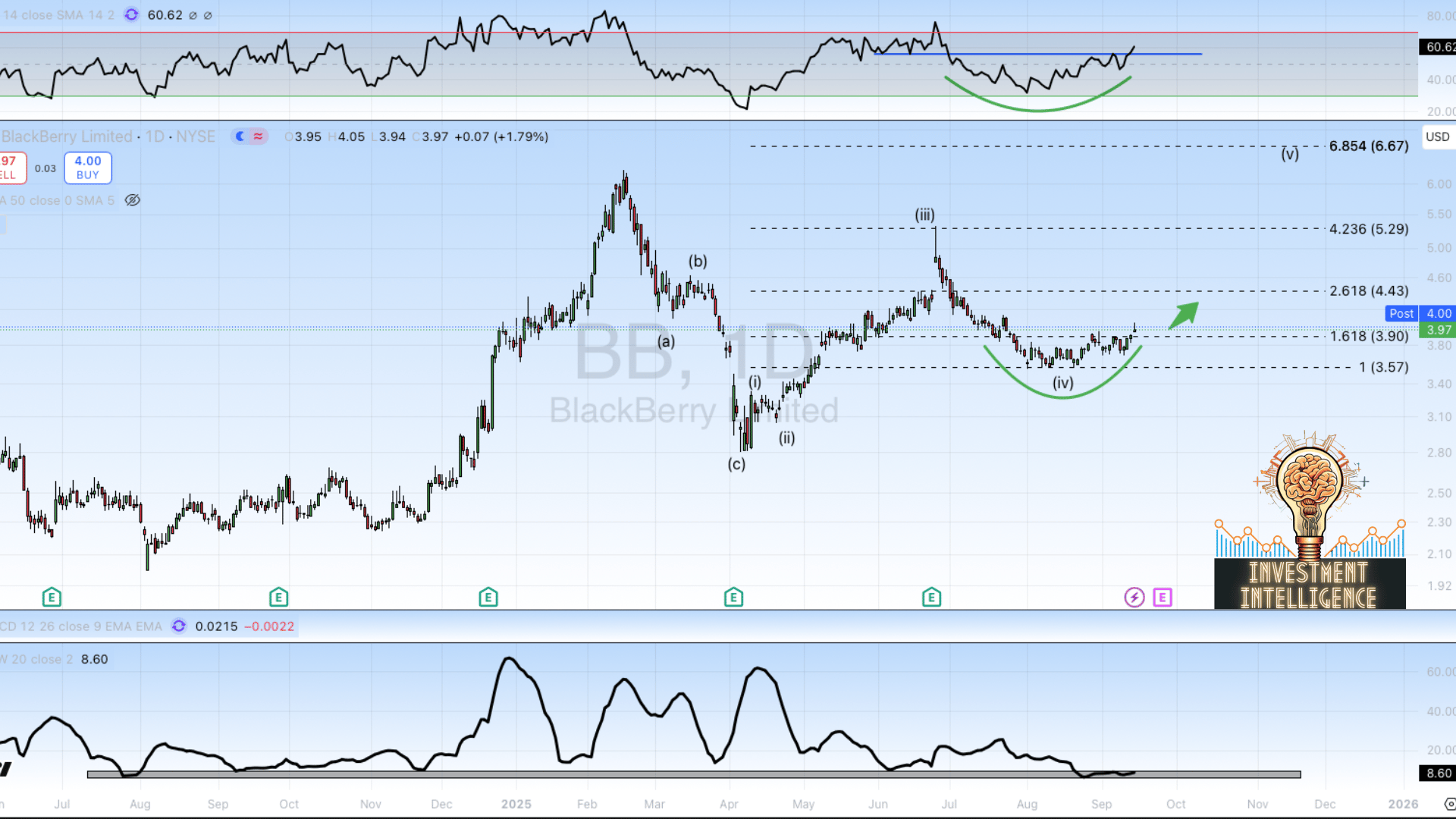

BB: Your Next Big Winner?

Speaking of setups that are getting us excited, check out BlackBerry (BB) right now. This thing is practically begging to be traded:

Price action: Breaking out of its base

Volatility: Compressed tight at the lows

RSI: Just crossed it’s breakout level

The risk management is beautiful too—stop at $3.90, first target at $4.43. That's a sweet risk-reward setup that any smart trader would love to take.

Why This Three-Step Formula is Absolutely Lethal

Alright, here's the thing—this isn't rocket science, but it's absolutely deadly effective. We've got our three-step process locked and loaded:

Step 1: We hunt for price breakouts - We want explosive price action that screams "something big is happening here!" When price breaks through resistance with authority, that's our green light that the big money is moving in.

Step 2: We demand volatility compression at the lows - This is the secret sauce right here. When we see that volatility getting squeezed tighter and tighter as price is setting up to breakout, it's like watching a volcano getting ready to erupt.

Step 3: We look for momentum confirmation - Here's where RSI comes to the party. We need momentum to confirm that this breakout isn't just a fake-out. When momentum breaks out alongside price, that's when we know this move has serious legs.

When all three of these components line up? That's when the magic happens. That's when we see moves like STX going from $158 to over $210, or those same-day 100%+ option gains on FSLY and CCJ.

The Seasonality Secret Sauce

While our three-component strategy is killer on its own, combining it with seasonal patterns is like adding rocket fuel to a Ferrari. Our seasonality dashboard (seriously, go read How Everyone’s Wrong About September Seasonality) helps us identify when certain stocks are historically most likely to explode.

STX's 90% September win rate isn't a coincidence—it's a pattern that's been repeating for years. When you combine rock-solid technicals with proven seasonal tendencies, you're not just trading—you're stacking the deck in your favor.

The Bottom Line: This Stuff Actually Works

This isn't some complicated algorithm that requires a PhD to understand. It's three simple steps that, when they align, create trading opportunities that can change your account balance in a single day.

The beauty is in the repeatability. STX, FSLY, CCJ, —all following the same playbook. All delivering the same explosive results. All proving that when you have a system that works, you stick with it and let the profits roll in.

Ready to Start Crushing It Too?

Listen, I could talk about this strategy all day, but at some point, you've got to stop reading and start doing. The three-component breakout setup isn't just theory—it's a money-making machine that's been delivering consistent wins for our community.

And here's the thing: we're just getting started. Our seasonality dashboard is packed with 300+ stocks that have been crushing it during specific months for the past decade. We're talking about historical win rates of 80-100%—the kind of edge that separates the pros from the wannabes.

Don't be the trader who looks back in six months wondering "what if." The setups are there, the system works, and the profits are waiting.

Until next time,

Investment Intelligence

Investment Intelligence Disclaimer: This article is for informational purposes only and not intended as investment advice. Always conduct your own research before making any investment decisions. Investment Intelligence is a financial publication of general circulation and provides impersonal advice, not tailored to individual needs. The comments or statements made in our newsletter do not necessarily reflect those of Investment Intelligence or its affiliates and should not be considered as buy or sell recommendations. Unless explicitly indicated, the content of any email communication from Investment Intelligence is not an official confirmation of any transaction. The recipient acknowledges that any use of this transmission and its attachments is at their own risk, and Investment Intelligence accepts no responsibility for any loss or damage arising from their use. It is the recipient's responsibility to ensure the emails are virus-free. Please note that we are a public investor and do not seek any material non-public information. We do not agree to keep any information confidential unless pursuant to a written confidentiality agreement executed by Investment Intelligence. Investment Intelligence does not agree to any restrictions on our trading activity, except as specified in a written agreement. Affiliate Disclosure: Investment Intelligence may be affiliated with certain entities and may receive cash compensation for referrals of clients who open accounts with those entities. Investment Intelligence may also receive compensation from product sponsors related to recommendations. Please be aware that by subscribing to Investment Intelligence, you agree to the terms and conditions outlined in this disclaimer. If you have any concerns or questions, please do not hesitate to contact us. Thank you for being a valued member of our community